The Frost Pllc Diaries

The Frost Pllc Diaries

Blog Article

Frost Pllc for Beginners

Table of ContentsThe smart Trick of Frost Pllc That Nobody is DiscussingFrost Pllc Things To Know Before You Buy

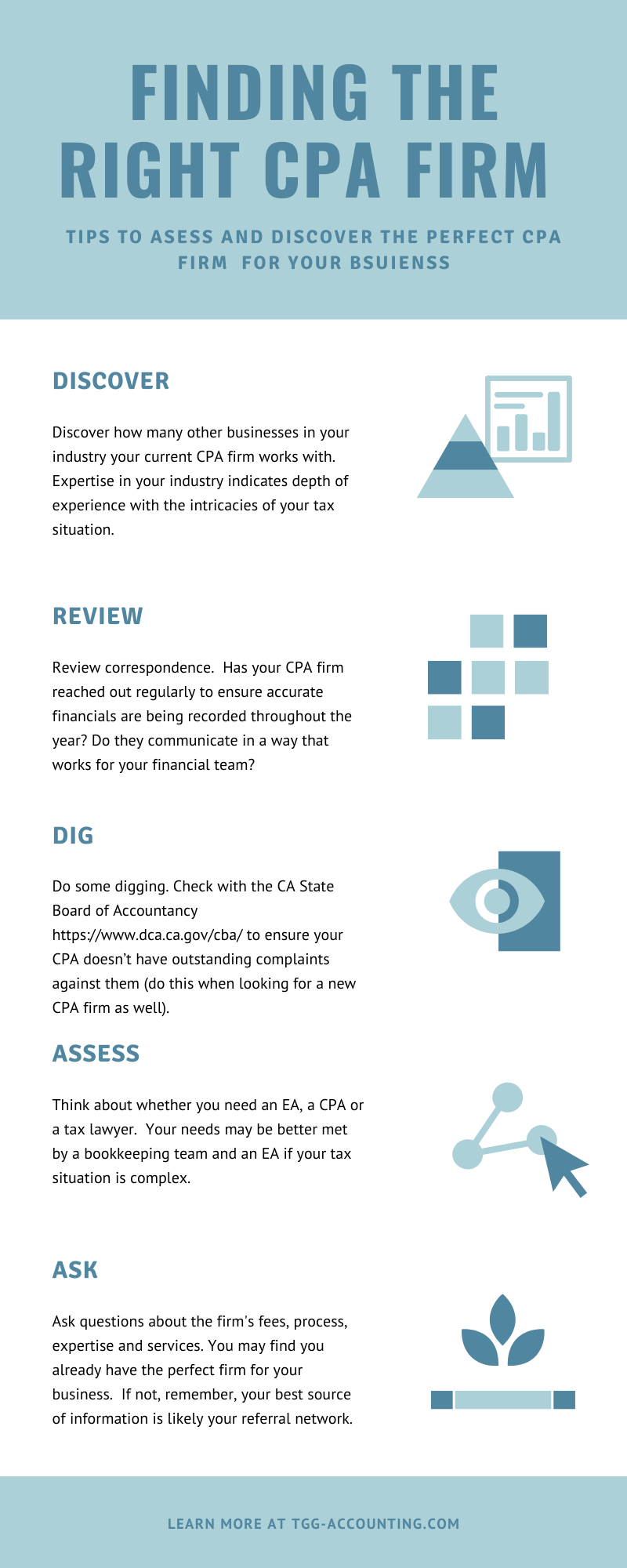

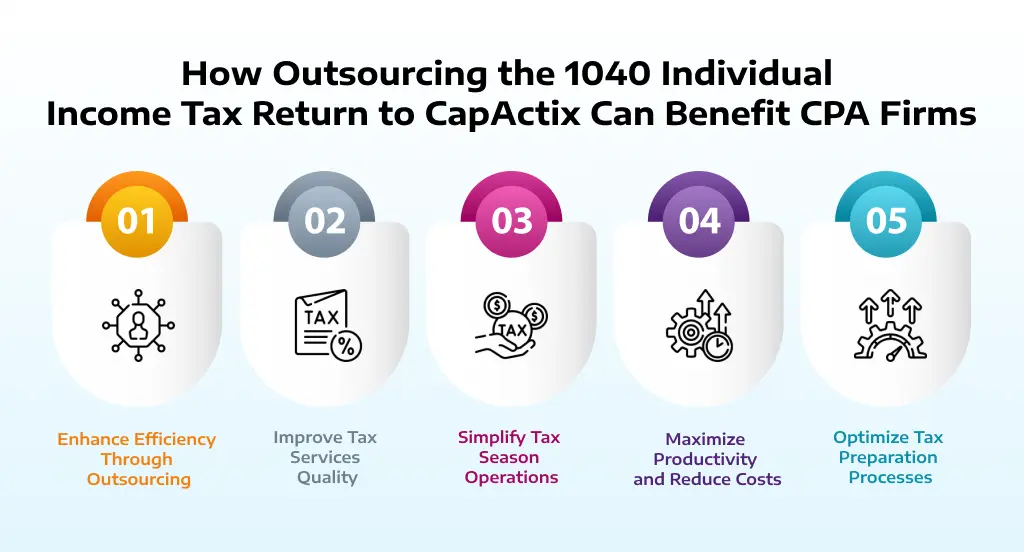

Certified public accountants are the" large weapons "of the audit sector and normally don't manage day-to-day bookkeeping jobs. You can make sure all your financial resources are current which you remain in good standing with the internal revenue service. Employing an audit firm is an evident choice for intricate businesses that can pay for a qualified tax obligation professional and a superb choice for any type of small company that intends to reduce the possibilities of being examined and offload the problem and migraines of tax obligation filing. Open rowThe distinction between a certified public accountant and an accountant is merely a lawful distinction. A CPA is an accounting professional licensed in their state of operation. Just a certified public accountant can offer attestation solutions, work as a fiduciary to you and act as a tax obligation lawyer if you deal with an IRS audit. No matter your scenario, also the busiest accounting professionals can ease the time burden of filing your tax obligations on your own. Jennifer Dublino added to this post. Source meetings were performed for a previous version of this article. Audit firms might likewise employ CPAs, yet they have various other sorts of accounting professionals on staff also. Often, these other kinds of accountants have specialties across locations where having a certified public accountant license isn't called for, such as management accounting, nonprofit accounting, cost accountancy, government accounting, or audit. That does not make them much less certified, it just makes them in a different way qualified. For these stricter policies, CPAs have the lawful authority to authorize audited financial declarations for the functions of coming close to capitalists and safeguarding financing. While accounting firms are not bound by these exact same policies, they need to Look At This still follow GAAP(Generally Accepted Bookkeeping Concepts )ideal techniques and exhibit highethical requirements. For this reason, Continued cost-conscious tiny and mid-sized firms will usually make use of an audit services company to not only meet their accounting and audit needs currently, but to scale with them as they expand. Do not allow the regarded reputation of a company packed with Certified public accountants sidetrack you. There is a misunderstanding that a certified public accountant company will do a much better work because they are legitimately enabled to

carry out even more tasks than a bookkeeping business. And when this is the situation, it does not make any feeling to pay the premium that a CPA firm will charge. Services can conserve on costs substantially while still having actually high-grade work done by making use of a bookkeeping solutions firm rather. Consequently, utilizing an accountancy solutions firm is commonly a far much better worth than hiring a CERTIFIED PUBLIC ACCOUNTANT

The Ultimate Guide To Frost Pllc

CPAs additionally have know-how in creating and developing business plans and treatments and assessment of the functional needs of staffing designs. A well-connected CPA can take advantage of their network to assist the company in various calculated and consulting duties, properly linking the organization to the excellent candidate to meet their demands. Next time you're looking to load a board seat, consider reaching out to a CPA that can bring worth to your organization in all the means detailed above.

Report this page